Insights on the latest equity crowdfunding Deals

Company and Team Overview

Started by Whitney White, a cosmetologist and beauty social media influencer with over 2.5 million followers across her platforms, Whitney got tired of overpriced natural haircare products that didn't deliver. Joined by Taffeta White, a legal and business consultant with over 18 years of experience consulting and scaling businesses, the pair co-founded Melanin Haircare, a natural haircare brand that is affordable and actually delivers.

Product Overview

Melanin Haircare currently offers five haircare products all made of natural ingredients. 4 of which are in the Top 5 fastest selling product segment in the haircare market. this products are;

Shampoo (African Black Reviving Shampoo)

Conditioners (Multi-Use Softening Leave-in Conditioner and a Plumping Deep Conditioner)

Hair oil (Multi-Use Pure Oil Blend)

other melanin product: Twist-Elongating Style Cream

Total addressable market and customer analysis.

Melanin haircare is taking on the $106 global haircare market which is expected to grow at a CAGR of 6.51% from 2024 to 2029. Rising awareness related to the benefits of natural haircare products is one of the key factors fueling market growth

Detrimental effects of using chemical-based shampoos and conditioners, such as dandruff, hair loss, dryness and other issues have spurred consumers to opt for natural products. Consumers have become ingredient savvy and they avoid picking products with sulfates, parabens and alcohol, thus boosting the demand for natural hair care products especially among Millennials who are the largest customer in the natural haircare market

Business model and the numbers

Melanin Haircare currently sells its products online directly to customers and globally in over 2,000+ retail stores predominantly in North America and the UK .

The startup claim to have a staggering 48% repeat customer rate compared to the 23% average in the beauty industry, which has led to over $23.5 million in lifetime revenue, showcasing great demand for their products.

In 2023, Melanin generated $5 million in revenue, a 24% increase compared to 2022 riding the wave of several pivotal change in consumer behavior, which include:

Rising health consciousness among consumers

Growing preference for organic and natural ingredients

Introduction of customized natural hair care products that cater to different hair types and needs

Social media influence and beauty trends promoting natural hair care

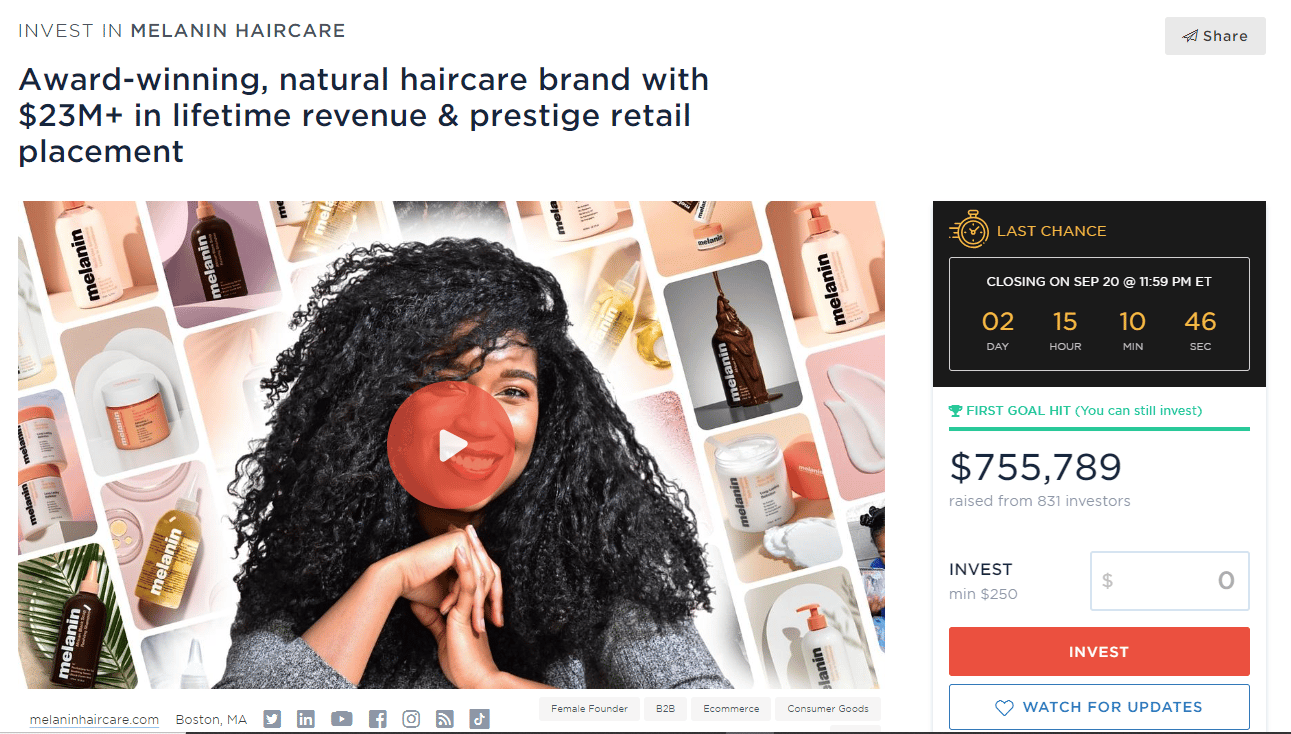

Funding

Melanin Haircare has raised funds from VMG Partners ($3.75M investment) and CircleUp ($3M investment). The company is currently raising a community round on Wefunder at a $24M SAFE (Simple Agreement for Future Equity).

The minimum investment amount is $250.

Analyst verdict

What are the Risk?

Top of my concerns is the thin gross margin of 14%. For the period ended December 31, 2023, the startup sold over $4.9 million of product, which translated to only $689,000 in gross profit. That’s before accounting for salaries, marketing, etc. After all those are included, Melanin Haircare lost a staggering $3.5Million.

To be fair, the gross margin is an improvement from the -3% gross margin of 2022, signaling growth. But will they be able to sustain this growth?

Secondly, Melanin Haircare is getting killed in General & Administrative (G&A) costs. In both 2022 and 2023, their G&A costs towered high at $2.4 million, taking up a significant chunk of the year's revenue. Although this is expected for this kind of startup, but To offset this specific costs, they will need to increase there revenue and margin. If they can increase gross margin to 20%, My Math shows they would need to reel in $12 million in revenue just to offset this specific costs. But again, can they achieve this feat?

A keen observation on there income statement shows the cost of inventory was nearly the same 2022 & 2023. despite this they achieved a 24% growth in sales 2023, which is good and shows they are optimizing cost.

This contributed to a 17% increase in gross margin in 2023 (-3% > 14%).

For 2024, they claim to be on track to sell $8 million, a 64% growth rate. The CEO mentioned other measures they've taken to improve revenue and margin, which include;

scaling production to meet Demand

expanding list of retail doors (14 new retail doors in Canada)

introducing new products to unlock new market opportunities

I believe these steps can place them on the right trajectory as they unlock more volume efficiency and aim for profitability. But there is big catch. The elephant in the room that needs to be addressed, and what is that?

Lastly, The elephant in the room remains that Melanin Haircare is operating in a very competitive market with already established players like:

Unilever: Acquired Sundial Brands in 2017 for an estimated $1.6 billion.

L'Oréal: Acquired Carol's Daughter in 2014

Johnson & Johnson: Acquired Vogue International parent company to OGX in 2016 for $3.3 billion. e.t.c

Additionally, the barrier to entry is quite low, meaning new players can enter and compete for market share.

Although I expect margin to increase for melanin haircare but at my assumption of 20% while costs are continually optimized in the next 2-4 years, my calculations show that for Melanin Haircare to be profitable, they will need to reel in $29 million in revenue. This is feasible in a $106 billion haircare market melanin is taking on.

While this is feasible in a 106 billion market, the challenge before melanin is an uphill battle, adding an additional $21m in topline from 2024 projection is a daunting task as their success in revenue growth would welcome in even more competitors to the space which will make it even more challenging to grow toplines.

While I acknowledge the risks, the natural haircare market outlook is promising and is poised to continue growing rapidly as consumer awareness increases. Melanin Haircare appears to be on the right trajectory too: The business is growing, the team is great, and they have products in demand.

Borrowing the investment scale of kevin fulmer of crowdscale what would melanin investment rating be?

Business model: 7/10

Opportunity for scale: 5/10

Competitor/risk: 3/10

Founder strength: 7/10

Exit potential: 7/10

AN INVESTMENT RATING: 56/100

Melanin haircare is currently raising a community round at a $24m SAFE on Wefunder and is currently accepting a minimum investment of $250

Would you invest in melanin Haircare?