Trump makes a U-Turn —without China

Last week was dominated by the intensifying U.S.-China trade war, with President Donald Trump imposing a cumulative 145% tariff on Chinese imports. China retaliated with tariffs up to 125% on U.S. goods.

This has dramatically shaken faith in the U.S. leading to significant sell-offs in U.S. Treasury notes and stock indices, erasing months or years of gains.

Midweek, Trump announced a 90-day pause on tariffs for all countries citing cooperative responses from over 75 trading partners. However, China was excluded from this pause due to its retaliatory action, as a result the Chinese yuan Took a hit falling to its lowest level in 18 years.

Toward the end of the week, The eagerly awaited inflation data from the US came in below expectations, leading to confidence in the market and a rapid rise in Bitcoin (BTC) which rose 7.5%, reaching $82,000. Ethereum also gained, climbing to $1,600, and Solana increased by 11%, reaching around $114.

The Consumer Price Index (CPI) for March increased by 2.4% year-over-year, lower than the predicted 2.6%. This eased fears of aggressive rate hikes and triggered a risk-on mood with the CMC crypto fear and Risk index now at 32 - an improved position from previous week 27

The latest data signals a potential shift in inflationary trends, while trade tensions with China continue to influence market sentiment.

In today’s update, we explore how the crypto economy and the RWA sector fared last week.

Let’s dive in!

RWA CRYPTO SECTOR RECAP

The real-world asset (RWA) sector has been on a downtrend since late January, with its market capitalization (mcap) seeing a significant drop over this period.

Over the past 7 days, the market experienced a significant rebound, with market cap climbing 6.81% to $46.21B following a midweek dip triggered by escalating U.S.-China tariff tensions. This recovery was driven by a risk-on shift in sentiment, as illustrated by the 39.90% surge in trading volume amid encouraging U.S. inflation data.

Most Real-World Asset (RWA) tokens, which were in decline earlier in the week, have since staged a notable recovery. The top five performers leading this resurgence are in the image below

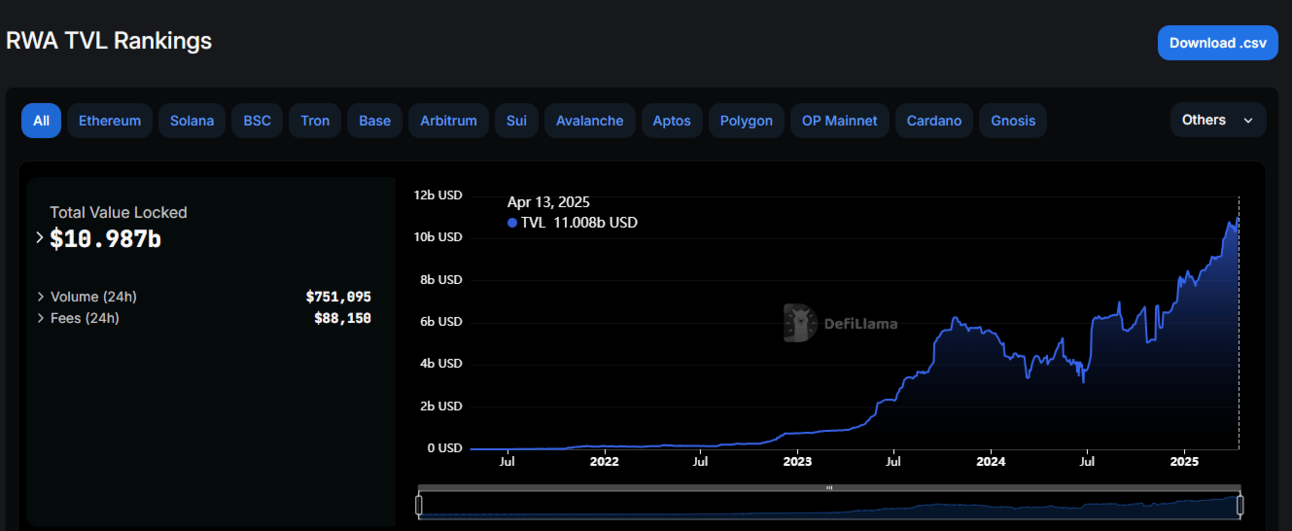

When it comes to the total value locked (TVL), the RWA sector continues to demonstrate strength. by the end of Last week it reached a new all-time high of $11billion.

CRYPTO RWA ROUND UP

Mantra Launches $108M Fund To Support Real-World Asset Tokenization, The initiative known as the Mantra ecosystem fund, (MEF) aims to invest in high-potential blockchain projects, focusing on real-world asset (RWA) tokenization and DeFi evolution. Link

Plume secured investment from private equity giants Apollo global The undisclosed amount will accelerate the development of Plume’s infrastructure and support its mission to make RWA as accessible and functional as any crypto-native asset. Link

TOKENIZED ASSET OVERVIEW

(RWA ONCHAIN)

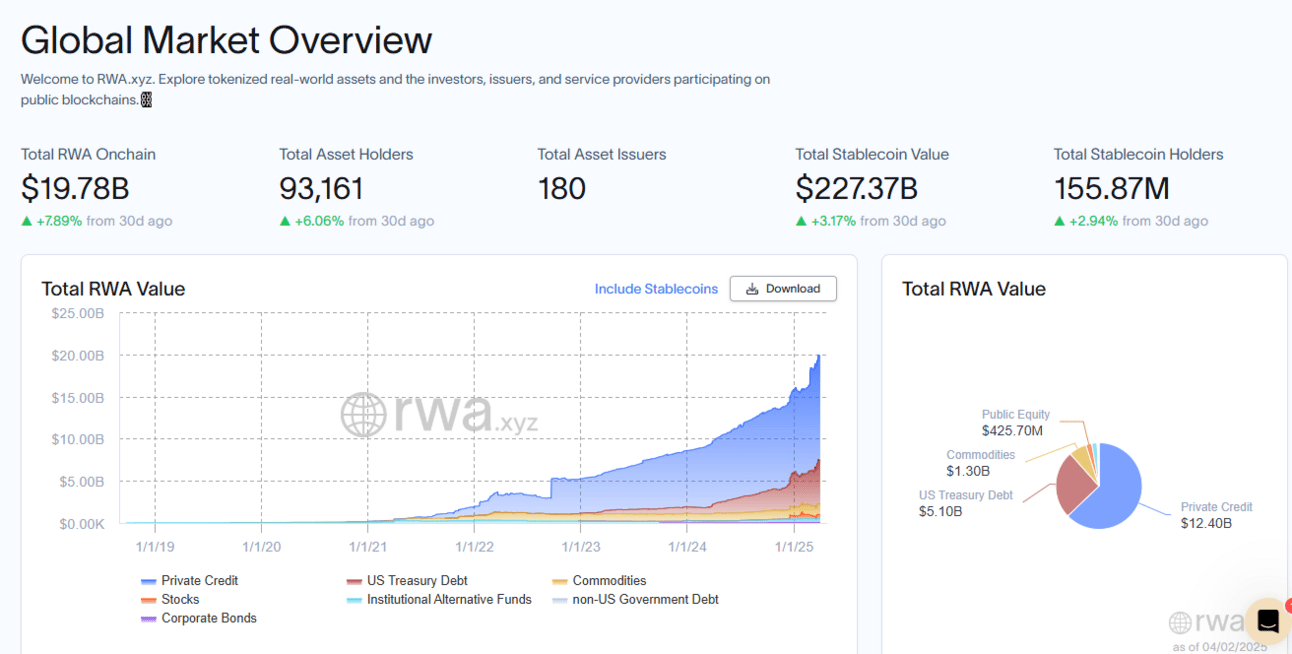

Total asset onchain added $1.1billion— growing from $9.78B 2 weeks ago to $20.88B as at the end of last week

Concurrently, BlackRock's BUIDL fund has achieved new milestones, with its assets under management reaching approximately $2.45 billion

TOKENIZED NEWS ROUND UP

Ripple, BCG Project $18.9T Tokenized Asset Market by 2033 Link

Standard Chartered, OKX, and Franklin Templeton launched a pilot trading platform designed to enable institutional clients to utilise cryptocurrencies and tokenised money market funds as off-exchange collateral for trading. Link

Tokenized Gold surpass $2B Market Cap as Tariff Fears Spark Safe Haven Trade Link

Ripple announced its acquisition of Hidden Road, a prime brokerage firm backed by Citadel Securities, Coinbase Ventures, and Wintermute, in a $1.25B blockbuster deal. HiddenRoad serves 300 institutional clients covering both digital assets and traditional securities. Link