The World Gets a 10% shock

On April 2, 2025, Trump stepped up to the podium and announced a sweeping 10% tariff on all imports into the United States, effective April 5. Dubbed a move to "protect American industry" and curb the widening trade deficit

The markets didn’t take the news lightly.

Wall Street went red within hours. The Dow plummeted 3.4%, the S&P 500 dropped 4.3%, and the tech-heavy Nasdaq took the biggest hit as it went down 5.5% in a single day.

The crypto market experienced significant volatility following the tariff announcement with Bitcoin dropping from around $88,000 to approximately $82,000 within hours.

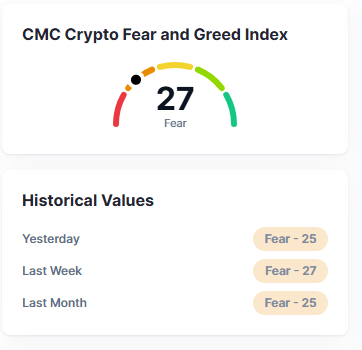

For the crypto market, the bearish sentiment remains largely unchanged. This is reflected in the CMC Crypto Fear and Greed Index, which stands at 27, the same as last week.

In today’s update, we explore how the crypto economy is holding up and how the RWA sector fared last week.

Let’s dive in!

RWA CRYPTO SECTOR RECAP

The real-world asset (RWA) sector has been on a downtrend since late January, with its market capitalization (mcap) seeing a significant drop over this period.

It’s been a turbulent week for the Real-World Asset (RWA) sector. Over the past 7 days, market cap slipped 4.35%, settling at $45.14 billion

Volume actually rose by nearly 10%, hitting $1.96 billion

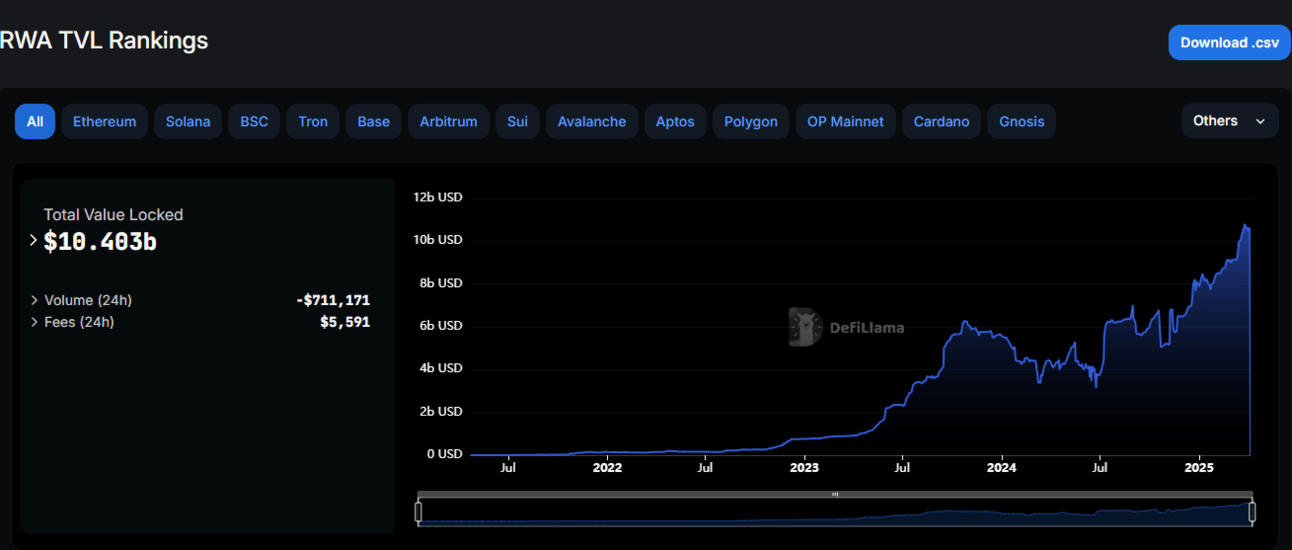

When it comes to the total value locked (TVL) in DeFi protocols, the sector continues to demonstrate strength. The sector briefly reached a new all-time high TVL of $10.8 billion before falling back to its current value of $10.4 billion within the week

TOKENIZED ASSET OVERVIEW

(RWA ONCHAIN)

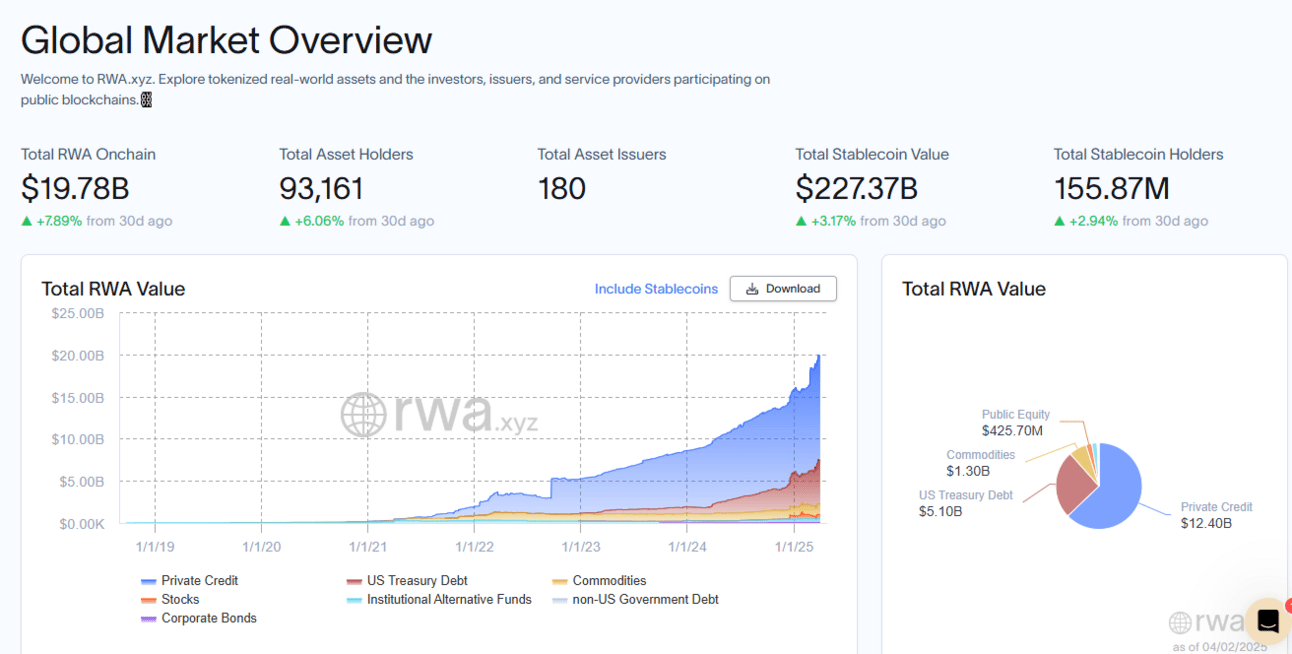

Total asset onchain continue to experience growth as it increased to $19.8B with private credit still maintaining the leading sector with $12.5B

Blackrock BUIDL continues to grow and it’s only $100K shy of a new $2B milestone.

For the month of march, it was reported the fund paid out $4.17M in dividend bringing its total dividend payout to $25M according to Crypto rovers

TOKENIZED NEWS ROUND UP

Tokenized Gold Market Surpasses $1.5B Amid Rising Gold Prices LINK

$6 trillion asset manager Fidelity launches retirement plan allowing direct crypto investments. LINK

BlackRock's Larry Fink posted his annual letter with focus on tokenization: "every stock, every bond, every fund, every asset—can be tokenized" Fink adds: "If SWIFT is the postal service, tokenization is email itself’’ LINK

Republic completed the acquisition of The INX Company through a $60 million purchase price to expand its U.S.-regulated trading platform assets. This transaction aims to establish Republic as an essential blockchain-based financial operation through enhanced possibilities for investing in tokens and digital assets. LINK

Sumitomo Mitsui Financial Group, Japan’s No. 2 banking group, has signed a Memorandum of Understanding with Ava Labs, Fireblocks, and TIS to initiate joint discussions on the potential utilization of stablecoins for future commercialization. LINK

Brazil’s largest bank, Itaú, with 98.5M customers, is reportedly exploring the launch of its own stablecoin, according to Valor Econômico, Brazil’s largest financial newspaper outlet. LINK

Calastone, the largest global funds network, has announced the launch of Calastone Tokenized Distribution—a solution that allows asset managers to tokenize any fund operating on Calastone’s network and distribute it across blockchain-based channels. LINK