THE BEGINNING OF THE END

Over the past two years, I’ve been vocal about equity crowdfunding because I believe everyone should be able to invest in the startups they love and access any financial Assets traditionally reserved for high-net-worth individuals (HNWIs).

To a very large extent i believe this can help reduce the global wealth divide gap which has been growing rapidly due to several factors, one of which is the exclusivity of the private markets which has outperformed the public market 18 out of 20 times in the last 2 decade.

While equity crowdfunding has provided a solution by democratizing venture capital , it still has several bottlenecks, such as:

Regulatory restriction on how much non - Accredited investors can invest

Limited secondary markets and liquidity to exit before an IPO or acquisition

Stereotypes still exist for founders exploring this funding method as they are seen as less quality, not high-growth or venture-backable, this has discouraged more founders Even though this sentiment has been proven untrue as we’ve seen startups like betabionic, service titan among others IPO and return capital for its early investors

For the past six months, I’ve been exploring RWA (Real-World Asset) tokenization, which I believe is a significant advancement in democratizing access to financial and Real world Assets traditionally reserved for HNWIs. This approach extends beyond venture capital to include asset classes like:

Private equity

Private credit markets

Real estate

Money market funds…and more.

While tokenization increases accessibility for retail, it also solves one of the biggest challenges institutional investors face - “Liquidity”

HOW IS THAT POSSIBLE? YOU MAY ASK

Tokenization basically means turning this financial and real world assets into digital tokens that are tradeable on the blockchain, this open up access and allow anyone to own a fractional piece of real world assets like Commercial Properties, luxury cars and other financial assets

..AND WHY DOES IT MATTER?

Except from the fact I’m an advocate of inclusivity to accommodate retail

Lets face it..

For institutional investors and HNWIs, The biggest challenge with their real-world assets (RWAs) like real estate, private equity, and other commodities is that, despite their trillions in value, much of this wealth remains trapped in slow, inefficient, and illiquid markets

For example, selling real estate typically takes 30 to 90 days, increasing holding costs for sellers. Private equity is even less liquid, with investors waiting years for an exit through acquisitions or public listings. This lack of liquidity ties up capital and limits reinvestment opportunities for investors

HOW DOES TOKENIZATION SOLVE THIS?

1. Increased Accessibility

Traditionally, investing in assets like real estate or private equity requires significant capital. Tokenization enables fractional ownership, allowing investors to buy small portions of high-value assets instead of purchasing the entire asset. This opens up opportunities for:

Traditional finance firms looking to tokenize funds and access Web3/crypto investors.

Web3 protocols and DAOs seeking on-chain, yield-generating tokenized TradFi assets.

2. Enhanced Liquidity

Selling real-world assets takes months or even years. Tokenized assets can be traded instantly on secondary markets, reducing long wait times for exits and making it easier for investors to cash out when needed.

3. Lower Transaction Costs & Settlement Time

Traditional asset transactions involve brokers, banks, and legal firms, adding extra fees and delays. Ownership transfers can take days or even weeks due to paperwork and regulatory processes. Tokenization eliminates these inefficiencies by using blockchain-based smart contracts, which automate transactions, reduce costs, and enable instant asset transfers.

4. Global Market Access

Tokenized assets can be traded 24/7 across international markets, removing geographical barriers that exist in traditional investment markets.

Several projects have already shown the power of tokenization across different asset classes like

RealT which allows retail investors purchase tokens that represent shares in income-generating Commercial properties, allowing them to earn rental income without the hassle of managing real estate directly.

Paxos Gold (PAXG) transforms gold investment by backing each token with one fine troy ounce of physical gold stored in secure vaults, providing a digital way to own the precious metal.

In March 2024, BlackRock, the world’s largest asset manager with over $11 trillion in AUM, introduced the BlackRock USD Institutional Digital Liquidity Fund (BUIDL)-a tokenized money market fund backed by U.S. Treasury bills on Ethereum. However, it's currently limited to crypto companies and DAO

Other tokenized Money market funds, like Hamilton Lane’s, have opened doors for retail investors, allowing them to invest with as little as $500 in its private infastructure fund

WHAT NEXT?

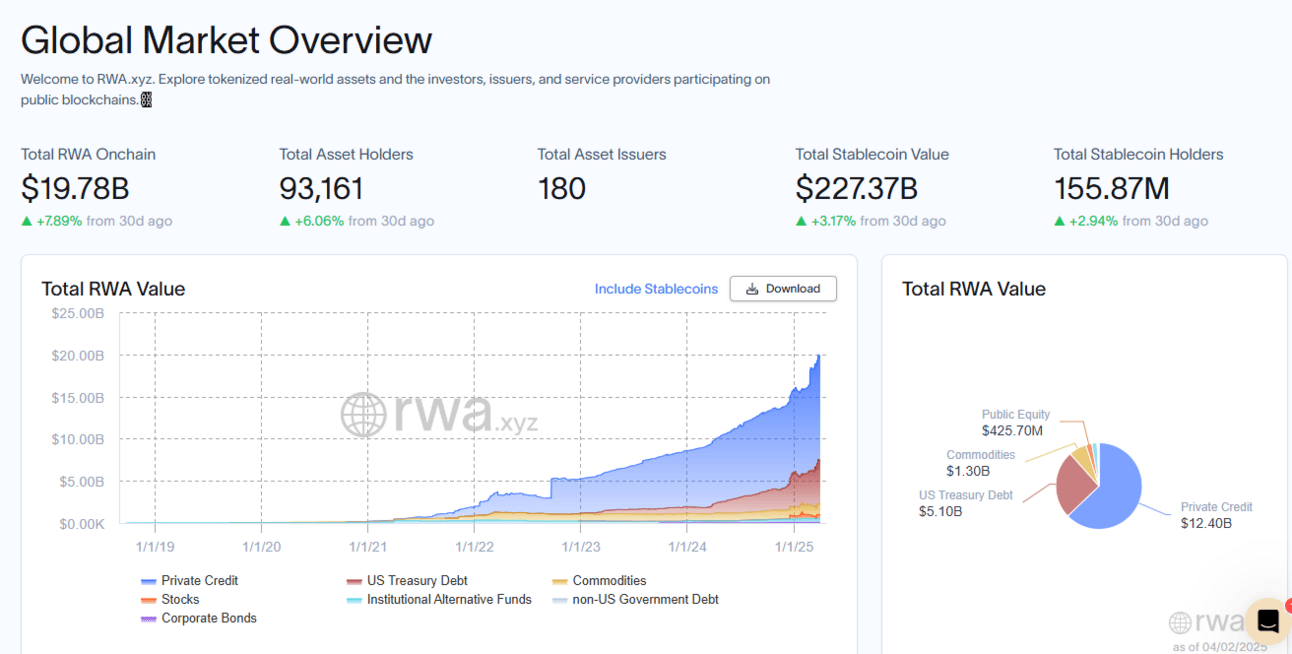

image via rwa.xyz

Real-world assets like real estate, treasuries, and other commodities are becoming liquid on the blockchain, unlocking over $19 billion in market value with significant growth potential on the horizon.

Major financial institutions entering the space further validate the sector's growth:

As regulations evolve and blockchain infrastructure matures, the adoption of tokenized assets will accelerate, unlocking billions in value across real estate, private equity, commodities and more.

For me, as an advocate of inclusivity in finance, this is a game changer, one that not only levels the playing field but also transforms how we invest in and interact with the world’s wealth.

This is an era of abundance and I can’t wait to share with you the opportunities of RWA tokenization as it unfolds.